16+ mortgage tax ny

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. If you live in the city you face property taxes and the New York City mortgage tax which.

Saving New York State Mortgage Recording Tax

Taxes Can Be Complex.

. Web Use SmartAssets free New York mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. You will not be subject to the NYC. Web 1 Refinance Your Existing Mortgage.

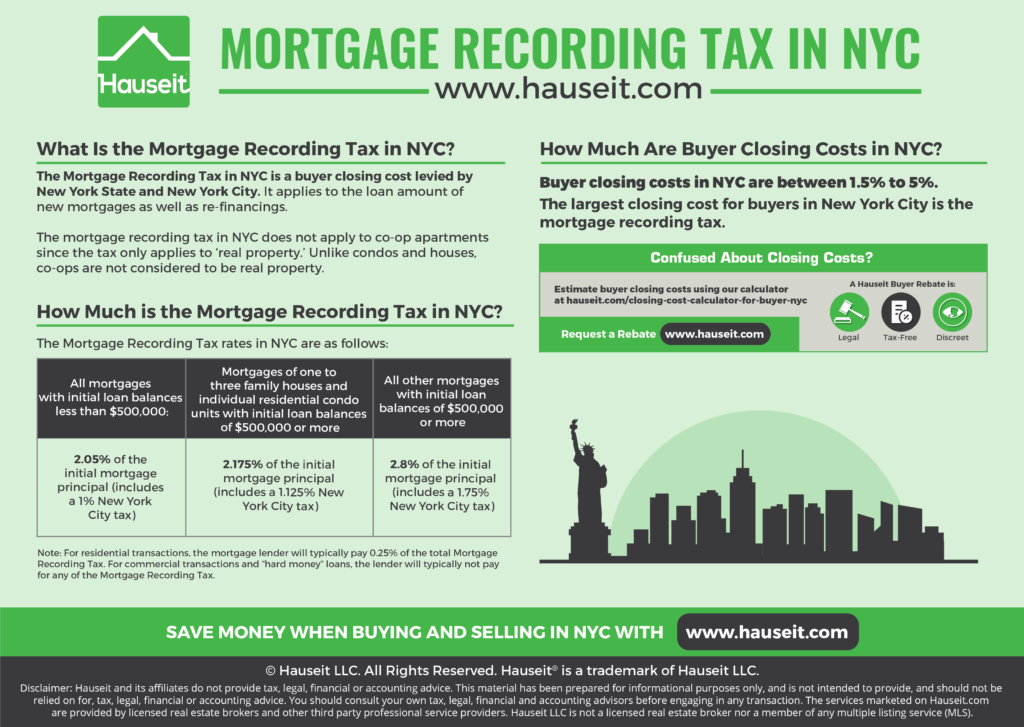

The borrower pays the entire amount. If you refinance your mortgage for an amount that is equal to or less than your current principal balance. Web Basic Mortgage Tax is 50 of mortgage amount.

Web 63 rows Todays mortgage rates in New York are 6872 for a 30-year fixed 5706 for a 15-year fixed and 6866 for a 5-year adjustable-rate mortgage ARM. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. The borrower pays 1925 minus 3000 if the property is 1-2 family and the loan is 10000 or more.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web In this instance the original mortgage recording tax is transferred along with the mortgage account and all of its interest to the new lending company.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. SONYMA State of New York Mortgage Authority aka Additional Tax is 30 of the mortgage amount. Compare offers from our partners side by side and find the perfect lender for you.

Web New York is also notorious for its taxes and real estate is no exception. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. If the property covered by.

The lender pays 25 if. Taxes Can Be Complex. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Z1 Gyilxk4ksxm

Additional Mortgage Tax Definition Propertyshark Com

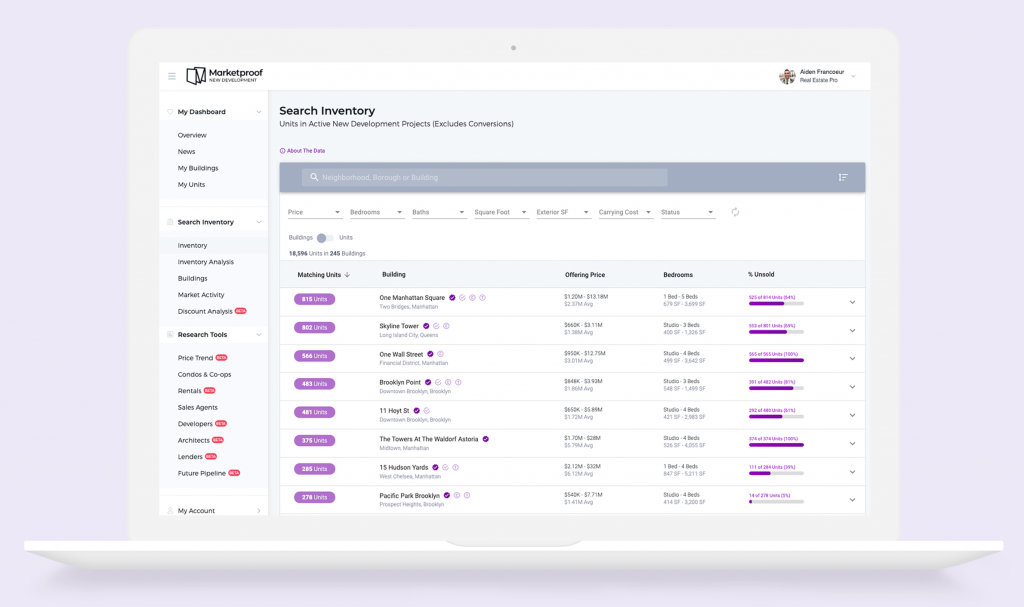

Nyc Mortgage Recording Tax Nestapple

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

Mortgage Recording Tax All You Need To Know Blocks Lots

What Is Mortgage Interest Deduction Zillow

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

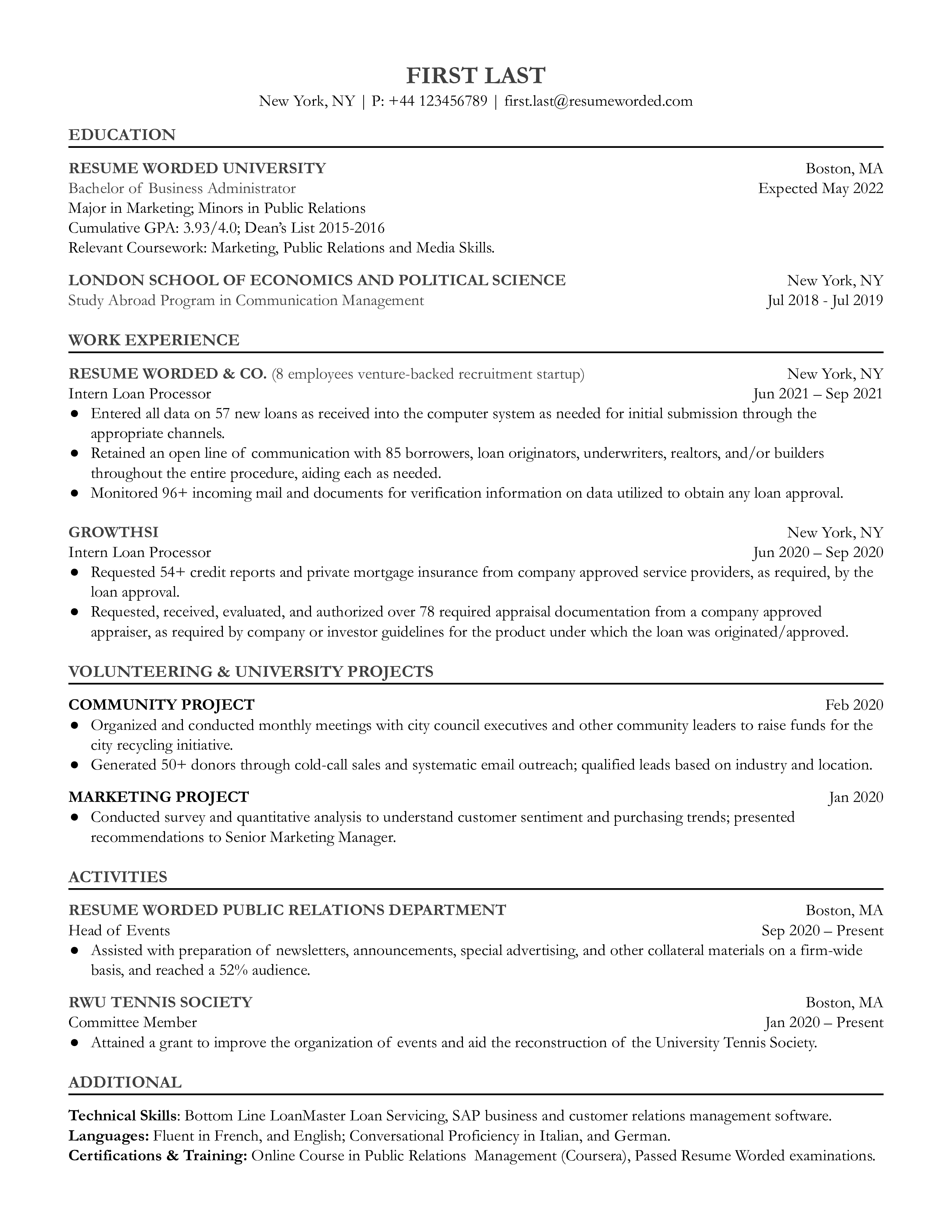

Entry Level Loan Processor Resume Example For 2023 Resume Worded

Bn35 082720 By Bridgton News Issuu

Who Pays Mortgage Recording Tax In Ny Cuddy Feder

Just Capital Methodology 0616

39 Green Briar Lane Lake Luzerne Ny 12846 Mls 202025591 Howard Hanna

How Much Is The Nyc Mortgage Recording Tax In 2023

16 Woodfield Lane Old Brookville Ny 11545 Single Unit Sfr Condo For Sale Loopnet Com

1381 County Highway 25 Richfield Ny 13439 Mls 130012 Howard Hanna

Are Property Taxes Included In Mortgage Payments Smartasset

Nyc Mortgage Recording Tax How To Avoid Paying